Contents:

Many people from all around the world are still looking for legal ways to withdraw money from Russia, Ukraine, Belarus, etc., and transfer funds to more secure locations. This is for purposes such as storage, investment, temporary refuge, "cleaning" money, and so on.

In recent years, trends in places like Dubai, Singapore, China, and Hong Kong are gradually losing their appeal due to rising tax rates (in Dubai), increased currency control by correspondent banks (mainly in China), and an unofficial direct ban on opening accounts for citizens of countries involved in conflicts.

Those who have ever considered a safe haven for their money know what I’m talking about. =)

Moreover:

Circumventing prohibitions can be quite expensive right from the company formation stage.

Not all jurisdictions allow you to open a company directly from Russia, for example. This increases costs due to the need for personal presence in places like Dubai. The direct cost "just for the documents" starts from от 5,000 USD.

After successfully establishing a company, there are only a few banks that will open a business account for founders who are citizens of conflicting countries. A substantial initial capital is often required (between 50,000 - 100,000 USD).

In the most popular jurisdictions, the cost of doing business can be significant, reaching $2,000 - $3,000 USD annually.

Is it worth opening a company for such purposes in Indonesia?

I won’t go into the details of the company formation process in Indonesia here. You can read more about it here - https://bali-legal.com/en/kitas-company-en. and about taxes - https://bali-legal.com/en/nalogi-v-indonezii-en.

This should give you a good understanding of whether this country is suitable for your business.

In short, here are the advantages:

You can open a company remotely.

You can appoint a remote attorney with limited powers.

The cost of starting a business starts at $1,300 USD.

You can obtain a 2-year residence permit for each owner.

All control over financial flows can remain with the remote owner.

Start a business in Indonesia at the best price

The lowest price on the market for 2 KITAS + company. Leave your request, and our manager will contact you shortly!

Submit a request

How Does the Banking System in Indonesia Work?

After establishing a company, you have the right (but not the obligation) to open a bank account in any bank in Indonesia in Indonesian Rupiah (IDR).

If you have a local attorney or director, you can also do this remotely. If not, you can open an account yourself as the director or founder of your own foreign-capital company (PT PMA).

For more information on types of companies in Indonesia, visit - https://bali-legal.com/en/business-bali-bez-oshibok-en.

- Banking Options: Indonesian banks allow you to open accounts in major freely convertible currencies such as:

EUR, USD, AUD, NZD, CHF, GBP, SGD, CHY, JPY.

This can be a single multi-currency account or several different accounts depending on how many currencies you need for your transactions.

Currency Exchange: Additionally, you can purchase currency yourself through any of the authorized currency exchanges in Indonesia.

2 - Local banks in Indonesia have weak currency controls, and generally, there are no additional checks for money that has gone through a correspondent bank.

Experience: Nobody ever asks about the source of funds. This may stem from the belief among Southeast Asians that Europeans are inherently wealthy. They find it hard to imagine that we also work and need to support ourselves! =)

3 - The SWIFT payment system operates effectively in Indonesia, with payments arriving within 3 banking days. However, be cautious with payments in Chinese Yuan; these always go through a Chinese correspondent bank and often either do not reach the recipient (your Indonesian company) or may take weeks to process.

For SWIFT transactions, it’s better to use EUR or USD.

4 - For receiving payments from cards (e.g., for online businesses), you can connect with PayPal.

Local E-commerce Solutions: Internet acquiring in local banks is still underdeveloped, so don’t expect your bank to have all the necessary software right away.

5 - If you receive funds in other currencies from abroad and don’t have a multi-currency account, the bank will automatically convert your funds to IDR at the current bank rate.

Typically, there are no limits on incoming transfers. For outgoing transfers in foreign currency, you can withdraw up to $100,000 USD per day (or the equivalent in another foreign currency). These limits do not apply to the local currency, IDR.

The Most Important Point!!!

Legal Cryptocurrency Trading: In Indonesia, cryptocurrency trading is legal, and there are even cryptocurrency exchanges that are officially regulated by the government.

Insight from a Friend: A friend of mine once remarked, “It’s like trading illegal substances legally and under government protection,” and he’s not wrong

How to Use Indonesia as a "Heaven"?

The process can look something like this:

1 - Open a Company in Indonesia.

2 - Open a Company Bank Account at any local bank. It’s best to consult with us first, as different banks have different requirements and nuances.

3 - The company director should register a personal crypto account on one of the authorized cryptocurrency exchanges in Indonesia. After passing the identity verification, they will receive an initial withdrawal limit of up to 200,000,000 IDR per day.

4 - The director then submits a request to change the account to a business account and obtains permission to submit the necessary documents.

5 - The director submits the documents as per the exchange’s requirements, and the account is listed.

6 - The crypto account is then linked to the company's bank account, allowing for an initial withdrawal limit of up to 1,000,000,000 IDR per day.

Generally, exchanges have limits on connecting company accounts, and not all can technically do this. We assist you with these technical challenges.

Connecting to a cryptocurrency exchange allows you to buy cryptocurrencies directly from the company’s bank account and send them to service providers, partners, or anyone with a crypto wallet =).

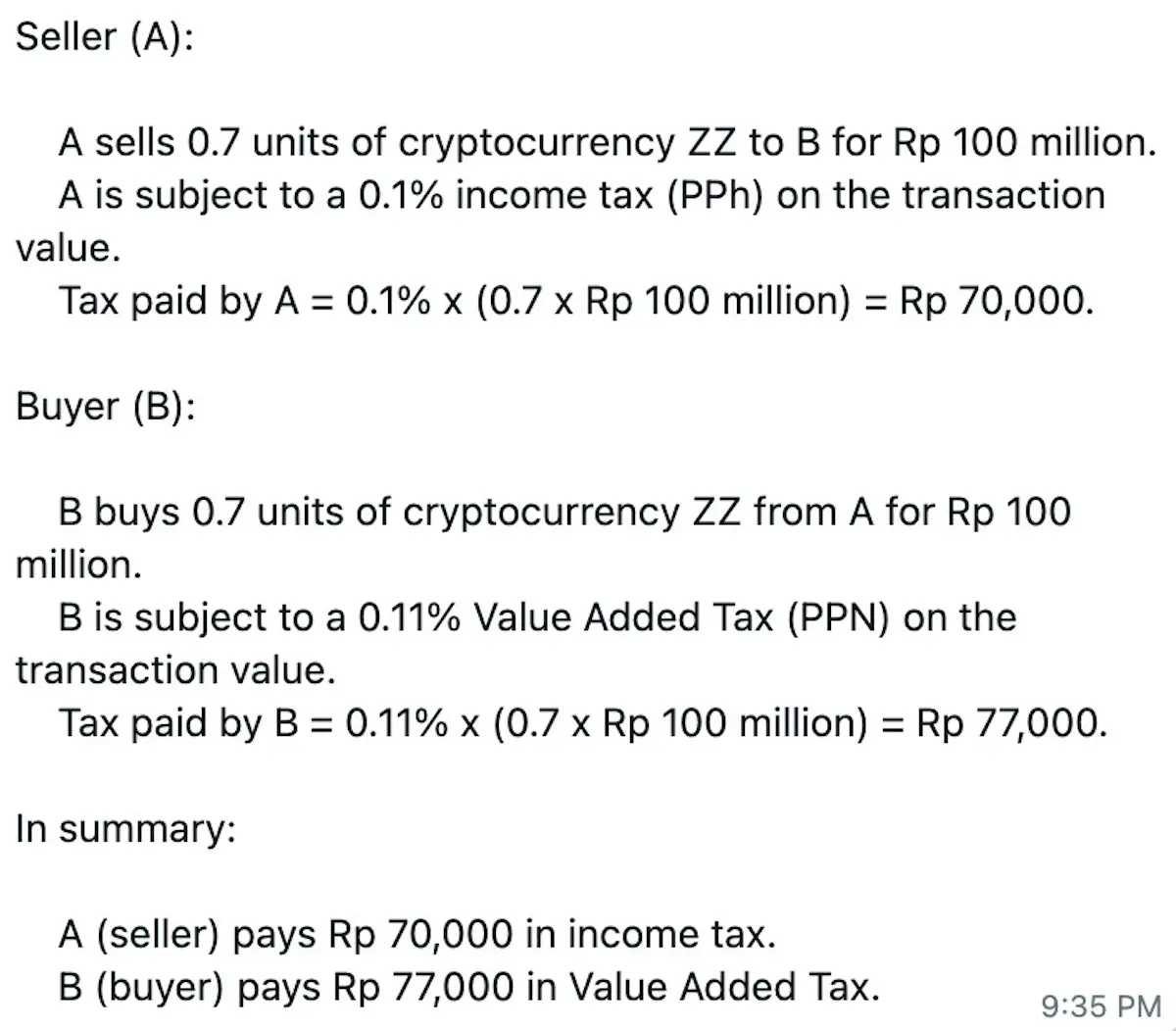

Here are the approximate fees for this procedure (requested from our manager at the cryptocurrency exchange in Indonesia):

If you need advice on opening a company and accessing all available local financial tools, please simply CONTACT US via TELEGRAM OR WHATSAPP for quick communication.

Summary of Expenses for Transferring 100,000 USD through a Company in Indonesia

Here are the anticipated costs and technical details for this process:

1 - Transfer Fee from Your Bank to an Indonesian Bank: Approximately 50 - 100 USD (for the company’s services and without currency conversion).

2 - Corporate Income Tax: 0,5%.

3 - Currency Conversion from USD to IDR: 0.5% (this depends on the bank and the amount). It’s often possible to negotiate a better rate for amounts starting from 5,000 USD.

4 - Transfer from the Company’s Bank Account to the Crypto Exchange: - 1 USD.

5 - Buying USDT with IDR on the Crypto Exchange: Approximately - 0,01-0,02%

6 - Tax on Cryptocurrency Purchase - 70 USD (as mentioned earlier).

Total Expected Expenses: Approximately 1,200 - 1,300 USD.

After this, the funds can be sent anywhere, with only the need to document the expenses.

We can assist in creating and managing this entire process. Contact us via TELEGRAM OR WHATSAPP for quick communication.

If you require more detailed advice on relocation, starting, and managing a business in Bali, please simply CONTACT US via TELEGRAM OR WHATSAPP for quick communication.

Together, we will make life on the island comfortable and legal!