Bank Card in Indonesia

-

VISA or MASTERCARD System

Ideal for receiving money from abroad and making payments for goods worldwide.

-

Convenient financial transactions

Favorable and secure currency conversion.

Daily limits of up to 12,000 USD.

Legal system for receiving funds through cryptocurrency.

Easy and straightforward transfer system throughout Asia.

Advantages of a Local Card for Russian-speaking Citizens:

You can use it almost anywhere in the world (there are some exceptions, but more on that later).

You can open either a VISA or MASTERCARD. This depends on the bank. We work with two banks – PERMATA (VISA) and MAYBANK (MASTERCARD).

There is a very convenient money transfer system within Asia and Indonesia. Instead of using a card number for transfers, each account is assigned a 10 to 12-digit number. To transfer money to another bank, just find it in the list of banks and enter that number.

The limits are increased to 100 – 200,000,000 IDR per day (about 12,000 USD). Your transactions are not constantly monitored, and your account won’t be blocked for exceeding the limit.

Obtaining a Local Bank Card

A local bank card can be obtained in two ways:

-

Having a KITAS (Residence Permit in Indonesia): Currently, this rule is in place for all banks.

-

Without a KITAS: You will need to provide a local sponsor/guarantor and a set of documents. This option is currently available at Maybank.

Getting a Bank Card Through a Sponsor/Guarantor

The bank requires a guarantor to ensure your reliability and financial stability. Not just any Indonesian will suffice. Banks have specific, fairly strict requirements for sponsors:

1. The guarantor must be an Indonesian citizen, over 18 years old.

2. The minimum capital of the guarantor’s deposit must be 10,000,000 IDR (approximately 700 USD), or roughly equivalent to two average monthly salaries in Indonesia. This is a significant amount for locals.

3. The guarantor’s account must have been opened at the bank for at least 6 months prior to their application to sponsor your account. This verifies the guarantor's reliability.

Due to these requirements and the increasing number of foreigners wanting to open local cards, banks have started issuing special permits/licenses for sponsorship.

Finding a guarantor in an unfamiliar country can be challenging, especially considering the many cases where guarantors disappear with funds on the island.

We assist with card openings and use our trusted guarantors.

Restrictions on Card Usage:

Due to military actions in Ukraine, Indonesia, in accordance with international agreements, has also imposed some restrictions on cards issued to residents of Russia::

You cannot make purchases on certain international websites.. For instance, if you want to buy an airline ticket online in Indonesia, not all sites will be able to process your card. Use the Traveloka website instead.

Receiving payments from Russia via the SWIFT system can be complicated. This is not due to the Indonesian card itself but because the SWIFT system is also declining in Russia. Nevertheless, keep this in mind when opening a card. Russian banks sometimes process transactions, while other times they delay them.

The card does not have a name on it. This can be important for some international payment systems. For example, in my experience, there was one website that required a named card for withdrawing funds from a partner account, and such a card would not qualify. In most cases, when a name is requested on the card, you can write your name in Latin characters (even if it isn’t on the card) or use the phrase "NO NAME." This works 99% of the time.

There are withdrawal limits at ATMsThe maximum allowed amount for withdrawal per day is 10,000,000 IDR (about 700 USD). However, these limits apply only to cash withdrawals. Transfers between banks of 5,000 to 6,000 dollars are absolutely normal.

If the balance on the card reaches 1,000,000,000 IDR (approximately 70,000 USD), the bank may require an explanation of the funds’ origin and freeze the account. This measure is aimed at combating illegal money circulation. Therefore, it’s better not to keep such a sum on a single card. Distribute the funds across multiple banks or keep part of it on the INDODAX cryptocurrency exchange.

Information That the Bank Will Preliminarily Request:

Date of birth

Maiden name of mother

Full name

Marital status

From what date have you been in Bali?

Indonesian phone number (this is mandatory)

Phone number in your home country

Complete residential address in Indonesia (a hotel address is also acceptable)

Complete residential address in your home country

Occupation (it’s best to specify business/freelance)

Name of the company you work for

Complete address of the company you work for (if you are an entrepreneur, you can provide your home address)

Phone number to contact your employer

How long have you been at your current job?

Your income in US dollars (no need to provide proof)

Your religion (strangely enough, this is also required by local banks)

Level of education

Passport details

Interestingly, while the bank collects quite a lot of information about you, it actually doesn’t use most of it. No one will verify your employer’s company, your work address, work phone, or income. Here’s what is actually checked:

Full name

Passport details

Indonesian phone number

Actual presence on the island

Cost of Card Production:

Permata Bank Visa

-

Cards are issued at the Denpasar branch

-

Cost of card production -

800,000 IDR

-

Waiting period for the card:

2 – 5 days

-

Non-removable deposit:

1,000,000 IDR for a multi-currency card (cannot be used)

-

Deposit:

500,000 IDR for a Rupiah card (100,000 IDR cannot be used)

-

This option is suitable for those who need a multi-currency card.

Maybank Mastercard

-

Cards are issued at the Denpasar and Ubud branches.

-

Cost of card production:

1,200,000 IDR

-

Waiting period for the card:

1 – 2 days

-

Deposit:

1,000,000 IDR (for Rupiah card), which can be used immediately.

-

Deposit:

250 USD (for Dollar card); 20 USD is “frozen,” the rest can be used.

-

For any questions, please contact the manager at BALI LEGAL

Using Cryptocurrency

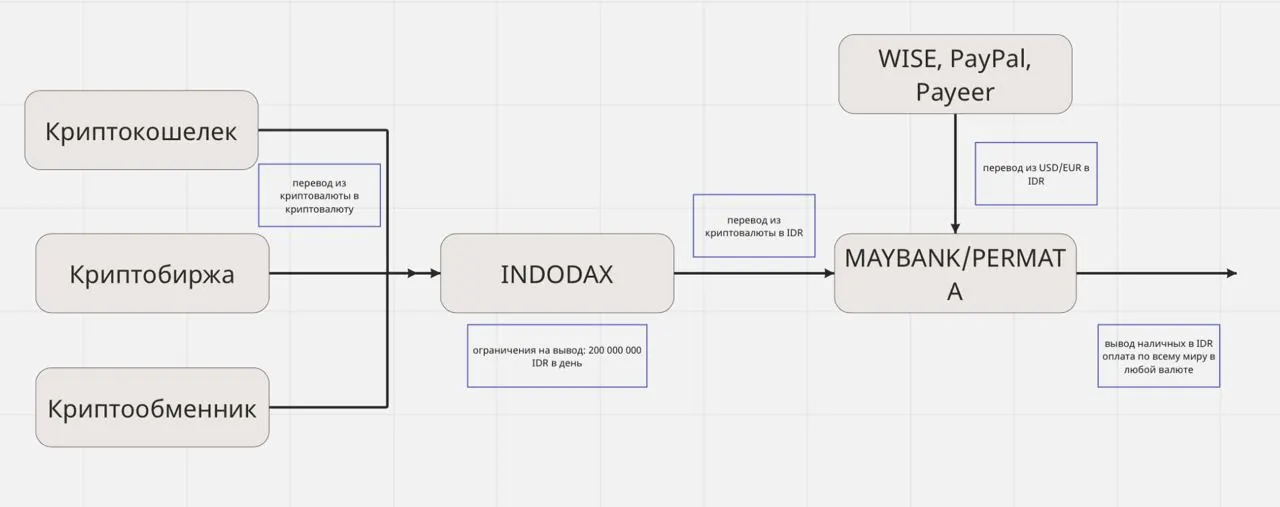

A system for accepting payments via cryptocurrency has been legalized. You can simply connect to a local cryptocurrency exchange and withdraw funds directly to your card. By opening a crypto account on a local exchange, you can create a very convenient system for transferring money worldwide, which will be outside of currency control.

How to Do It? Step-by-Step Plan:

-

Open a crypto account on the local exchange, Indodax. Currently, the local exchange does not open accounts for Russian citizens, but we have found a way to do this and can help you open an account.

-

Download the Indodax app on your mobile phone. (Please note that the app will only work with a phone that has an Indonesian SIM card. Confirmation SMS messages for login will be sent here.)

-

Open a local bank card (e.g., PERMATA). In the Indodax app, link your bank card to your Indodax account.

Now, if you buy cryptocurrencies from anywhere in the world, you can easily transfer them to your crypto account and then to your bank card. The entire process takes about 2–3 minutes. The loss of funds on transactions and banking costs for an amount of 1,000 USD will be around 1–1.5 USD.

If you have any questions related to opening a bank card in Indonesia, CONTACT US on TELEGRAM or WHATSAPP for quick communication.

Have any questions?

Leave a request for a free consultation and our manager will contact you as soon as possible