How to open a company in Bali and get a 2-year residence permit – I’ve already written about it here https://bali-legal.com/en/kitas-company-en.

What reports to file and how to maintain such a company - https://bali-legal.com/en/tax-reports-bali-en.

BUT!!! This topic isn’t limited to just legally registering a company and filing tax reports. Here’s what I’ve got, roughly speaking, in numbers:

More and more people are coming to us with the goal of building turnkey business processes, where opening a company is just the foundation for the future:

Working with suppliers and agents;

Moving funds through the company (including from Russia);

Tax optimization down to 3-4% on average for all transactions;

Setting up legal contractual relationships;

Legalizing the main type of activity in Indonesia (even if that activity is initially restricted for foreigners).

In this article, I’ll cover the key points of setting up a company and specific steps you can take right now if you plan to do business in Indonesia.

Advantages of starting a business in Bali

Low tax burden for small businesses (up to 350,000 USD in annual turnover). About taxes: https://bali-legal.com/en/nalogi-v-indonezii-en;

Opportunity to optimize taxes down to 3-4% for companies with over 350,000 USD annual turnover.

Free movement of funds globally.

No strict currency control (documents for reports and payments are rarely checked or requested).

Ability to purchase property in Bali. More info here - https://bali-legal.com/en/kupit-i-postroit-nedvizhimost-na-bali-inostranczu-en;

It can be opened remotely, quickly, and affordably. Comparison with other countries in the region: - https://bali-legal.com/en/luchshee-reshenie-dlya-otkryitiya-biznesa-en.

More articles about doing business in Bali: https://bali-legal.com/en/blog-en.

Types of companies with foreign ownership based on business location

So, foreigners can open a company in Bali even remotely, without entering the country.

The minimum requirements are:

2 foreign shareholders;

An office on the island (a virtual office is possible) - https://bali-legal.com/en/office-bali-en

Define your legal business activity. A complete list of activities from the source: https://oss.go.id/en/informasi/kbli-berbasis-risiko. To check your type of business, you’ll need to register with the Ministry of Foreign Investment Control.

Depending on the GOAL OF THE BUSINESS, companies in Bali can be divided into 2 types:

Internal Companies – for working in the domestic market

Businesses that are most commonly started by foreigners for local operations:

Cafes, restaurants;

Spa, massage (massage is restricted for foreign companies);

Development;

Construction (restricted for companies with foreign shareholders, but it can be legalized);

Visa agencies;

Tourism business;

Long-term rental of villas/apartments;

Renovation;

Stores selling locally produced goods;

Leather, silver, wood crafting;

Furniture manufacturing;

Retreat centers;

Yoga and meditation centers;

Rental of motorbikes and cars.

The goal for these types of businesses when starting up is to ensure the legality of their earnings on the island and create a legal structure for operations from legal, financial, and tax perspectives.

Start a business in Indonesia at the best price

The lowest price on the market for 2 KITAS + company. Leave your request, and our manager will contact you shortly!

Submit a request

External Companies – for both domestic and international markets

These are businesses that foreigners often set up under this scheme:

Import-export companies. The main challenge here is calculating import/export duties. There’s an option to operate with zero duties in some cases.

Parallel import companies. These are mainly used to transfer funds through Indonesia, functioning as agents.

Consulting companies, receiving payments from clients worldwide. They benefit from low tax rates and the ease of managing and receiving funds.

Small European companies and households, looking to reduce the tax burden on their main businesses and move funds out of Europe.

Online stores and small marketplaces. Connecting a payment processing system (acquiring) in Indonesia is not easy, but we have solved such tasks before.

The goal for these businesses during setup is to legally move money for their own benefit or on behalf of their clients worldwide, receive payments from any part of the world, and simplify fund storage while reducing taxes.

What types of businesses are prohibited in Bali?

Some popular and less obvious types of activities that foreign companies/entrepreneurs cannot legally or unofficially engage in in Bali include:

1 - Construction. Only LOCALS are allowed to build.

Solution – You can sign a contract with a local company to build your property and pay a tax of 2 to 4%. You can hire either as a private individual or as a company. A foreign company cannot get a construction license, but ANY LOCAL INDONESIAN, EVEN WITHOUT EDUCATION, CAN LEGALLY BUILD!

2 - Renting motorbikes and cars. Although a foreign company can technically get a license on a national level, local authorities will likely not allow the business to operate in their area. Learn more about how this works here: https://bali-legal.com/en/bandzhar-glavnaya-vlast-na-ostrove-en.

Solution – Before opening the company, negotiate with the local governing body – Bandjar..

More about Bandjar - https://bali-legal.com/en/bandzhar-glavnaya-vlast-na-ostrove-en

3 - Daily rental of villas/apartments. While you can include this activity in your company’s official documents, obtaining a license won’t be possible. Additionally, questions will arise like, “Why is the company operating without a valid license?”

Solution – Set up an agency agreement for initial client handling. One company (your foreign company) handles the rental payments, and the second (a local company) receives payment for the daily rental minus a commission.

4 - Massage. Local governing bodies (Bandjar) are likely to block the establishment of a new massage business because it competes with local operations. Also, this type of activity cannot be listed in official company documents.

Solution – The primary business activity for a foreign capital company should be SPA services, which can include massages, yoga practices, and nail care. Similar to renting motorbikes, it’s best to negotiate with village representatives before opening the company.

5 - Advertising your business on social media. If you’re selling internationally, there are no issues. However, if you sell directly to the local market and openly advertise on social media, you risk a fine of 60,000,000 IDR, annulment of your KITAS (residence permit), and deportation.

Solution – Protection. More on how this system works in our Telegram channel bot - https://t.me/balilegal

IMPORTANT!!! As a company owner in Bali, you do not have the right to advertise your products directly. This activity is regulated and also falls under the list of restricted activities for company owners.

PROHIBITED ACTIVITIES CAN OFTEN BE LEGALIZED!!!

If you need a consultation on how legal your business is, or the business you plan to open, feel free to CONTACT OUR MANAGER ON THE ISLAND via - TELEGRAM OR WHATSAPP for quick communication.

A Few Words About Share Capital

Besides the real advantages of starting a business in Bali, regardless of its type, there is one legal obstacle – "share or statutory capital".

BY LAW!

The SHARE CAPITAL of a company must be at least 10,000,000 IDR per shareholder (approximately 700,000 USD).

That means for a company with two shareholders holding 50% each, the required capital would be 1,400,000 USD.

IMPORTANT!!!

During the company setup process, we bypass the requirement of mandatory capital deposit by stating in the documents that the capital has been deposited.

There is currently no strict enforcement of capital deposit requirements! This benefits both parties, as not depositing the capital is a common practice, creating fertile ground for bribery from entrepreneurs =)

BUT!!! There is still a risk that the state may demand the capital deposit from the entrepreneur.

How to reduce this risk?

File your monthly, quarterly, and annual reports on time. More about the types of reports - https://bali-legal.com/en/tax-reports-bali-en

Show a positive quarterly growth of the share capital, even if it's just 1,000,000 IDR per quarter.

Ideally, deposit 10% of the share capital within the first year of business operations (this is more relevant for development companies).

If you don’t plan to operate a real business on the island and are using the company for holding and transferring money, consider appointing a nominee manager from Indonesia to handle business operations.

Monthly PROMO

till 30.11.2024

Get a 50% discount on an extended consultation

When opening a company and 2 KITAS with us. The promotion is valid for all new clients!

Take part

Essential Steps to Start a Legal Business from Scratch in Bali

1 - Identify Two Shareholders and Their Stakes in the Company

If you want not only to start a business but also to obtain a residence permit (KITAS), each shareholder must hold at least 10% of the company shares. For example, two shareholders with a 50/50 share split. The minimum share capital“ on paper” must be 20,000,000,000 IDR.

2 - Choose a Company Name

The name must include at least three words in Latin script. Each word must have a minimum of four letters. The name must start with the PT abbreviation. For instance, PT BALI FOREIGN LEGAL.

3 - Define the Type of Business Activity

Ensure that the chosen business activity is legal in Bali and find out how to legalize it. A full list of permitted activities is available here - https://oss.go.id/en/informasi/kbli-berbasis-risiko.

To check if your business activity is legal, you need to register with the Ministry of Foreign Investment Control. Examples of businesses: export/import, consulting.

Need help checking if your business is legal? please simply CONTACT US via - TELEGRAM OR WHATSAPP for quick communication.

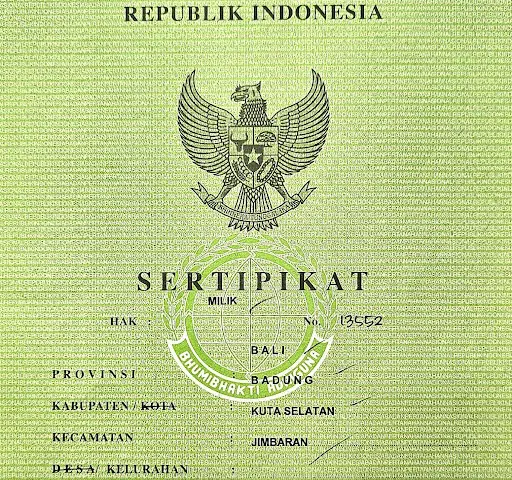

4 - Obtain and Verify Company Documents

Once your company is registered, you will receive (by hand or mail) the following documents. Ensure their accuracy and validity:

DEED OF INCORPORATION

AKTA PENDIRIAN PERSEROAN TERBATAS (DEED OF INCORPORATION OF A LIMITED LIABILITY COMPANY)

KONFIRMASI KESESUAIAN KEGIATAN PEMANFAATAN RUANG (for each license)

PERNYATAAN MANDIRI (INDEPENDENT STATEMENT for each license)

PERIZINAN BERUSAHA BERBASIS RISIKO SERTIFIKAT STANDAR (RISK BASED BUSINESS LICENSING STANDARD CERTIFICATE for each license)

NPWP NUMBER (BISINESS TAX NUMBER)

KEPUTUSAN MENTERI HUKUM DAN HAK ASASI MANUSIA REPUBLIK INDONESIA (DECISION OF THE MINISTER OF LAW AND HUMAN RIGHTS OF THE REPUBLIC OF INDONESIA)

NOMOR INDUK BERUSAHA (BUSINESS IDENTIFICATION NUMBER)

PENGESAHAN PENDIRIAN (VALIDATION OF ESTABLISHMENT)

SURAT PERNYATAAN KESANGGUPAN PENGELOLAAN DAN PEMANTAUAN LINGKUNGAN HIDUP (STATEMENT OF ENVIRONMENTAL MANAGEMENT AND MONITORING CAPABILITY)

*5 (Optional) Apply for the Investor Visa E28A

You need a passport valid for at least 30 months. This visa is necessary if you plan to personally manage your company.

For instance, if you're opening a cafe and plan to live on the island, this visa will allow you to sign contracts, manage the company, and reduce the tax on dividends. Alternatively, if you’re establishing a parallel import company, you can delegate management to a local resident.

*6 (Optional) Obtain the E28A Visa and Fly to Bali

You need to enter the island within 30 days to receive the official KITAS. It's recommended that you hand over your passport to immigration officers right at the airport for immediate processing.

For example, if you arrive on April 30, 2024, you will get a temporary stamp allowing you to stay until May 30, 2024.

More about KITAS - https://bali-legal.com/en/kitas-(vnzh-na-2-goda)-en.

*7 (Optional) Convert Your E28A Visa to a KITAS

By converting your E28A visa into a KITAS (Temporary Stay Permit), you gain several advantages:

Reduced income tax from 20% to 10%.

Directly manage the company (including opening bank accounts, signing contracts as the director, and submitting tax reports).

Obtain a 2-year residence permit in Indonesia.

For example, if you use your company as an active business and pay yourself official dividends, with a KITAS, you will pay only 10,000,000 IDR tax on every 100,000,000 IDR of net company profit, whereas a foreign citizen would pay 20,000,000 IDR in taxes.

8 - Choose a Bank and Open a Business Account

After receiving your KITAS (which will be sent in electronic format), you can open a business account independently or with our assistance.

Important! You are ot required to open a business bank account to conduct commercial activities in Bali.

We recommend the following three banks, each offering different benefits depending on your business needs:

Banks in Indonesia often refuse to open accounts without a KITAS. So, it's generally better for the company director to have one (see previous steps).

Choosing the Right Bank for Your Business

BRI BankBest for local businesses - BRI Bank Fast account setup. Offers a local payment card for conducting transactions in Indonesia.

Ideal for international businesses - OCBC Bank Higher limits on withdrawals. Ability to make online transfers worldwide through SWIFT. Easily connects with crypto accounts for payments and transactions in cryptocurrency.

*9 (Optional) - Open a Cryptocurrency Account with INDODAX

This option is more relevant for those operating international businesses. Local businesses may not need this. In many countries, accepting payments in cryptocurrency through a company is difficult or impossible. Indonesia allows this legally.

For example, if you have a business involved in parallel importing, receiving payments from Russia to China, you can - Receive payments in USD or EUR into your company’s account. Convert those funds into Indonesian Rupiah (IDR). Purchase USDT (a stable cryptocurrency) and send it anywhere in the world with a commission of around 0.07% to 0.1%..

*10 (Optional, but Highly Recommended) - Obtain a Tax Number for the Director

Without a tax number, you cannot proceed to the next step. Additionally, your personal tax rate will only reduce if you have this tax number as a physical person.

11 - Connect Your Company to the EFIN Remote Tax Reporting System

Indonesia has centralized tax reporting, which is done through a local accountant or tax specialist. To connect to this system, the company director (you) must have a tax number and KITAS.

If you need a detailed consultation on relocation, starting a business, or managing taxes in Bali, please simply CONTACT US via TELEGRAM OR WHATSAPP for quick communication.

Together, we’ll make your life on the island comfortable!